Journal Entry For Bought Goods From Shyam On Credit . journal entry for purchasing goods on credit. (i) goods returned to mahima for rs 5,000, entered into sales returns. For a business operating a perpetual inventory system the accounting records will show the following bookkeeping entries when you buy goods on credit from a supplier: Providing goods to the customer with an expectation of. Nirmal has the following transactions in the month of april. We can make the journal entry for purchasing goods on credit by debiting the purchases. In case of a journal entry for cash. Sold goods to a and money received through rtgs ₹. Write journal entries for the transactions. accounting and journal entry for credit purchase includes 2 accounts, creditor and purchase. ‘sold goods on credit’ is nothing but the sale of goods on a credit basis i.e. pass necessary journal entries' to rectify the following errors: Buy goods on credit journal entry. Commenced business with cash ₹ 4,00,000, goods ₹ 5,00,000.

from zetran.com

pass necessary journal entries' to rectify the following errors: (i) goods returned to mahima for rs 5,000, entered into sales returns. Write journal entries for the transactions. In case of a journal entry for cash. Providing goods to the customer with an expectation of. accounting and journal entry for credit purchase includes 2 accounts, creditor and purchase. We can make the journal entry for purchasing goods on credit by debiting the purchases. Nirmal has the following transactions in the month of april. journal entry for purchasing goods on credit. ‘sold goods on credit’ is nothing but the sale of goods on a credit basis i.e.

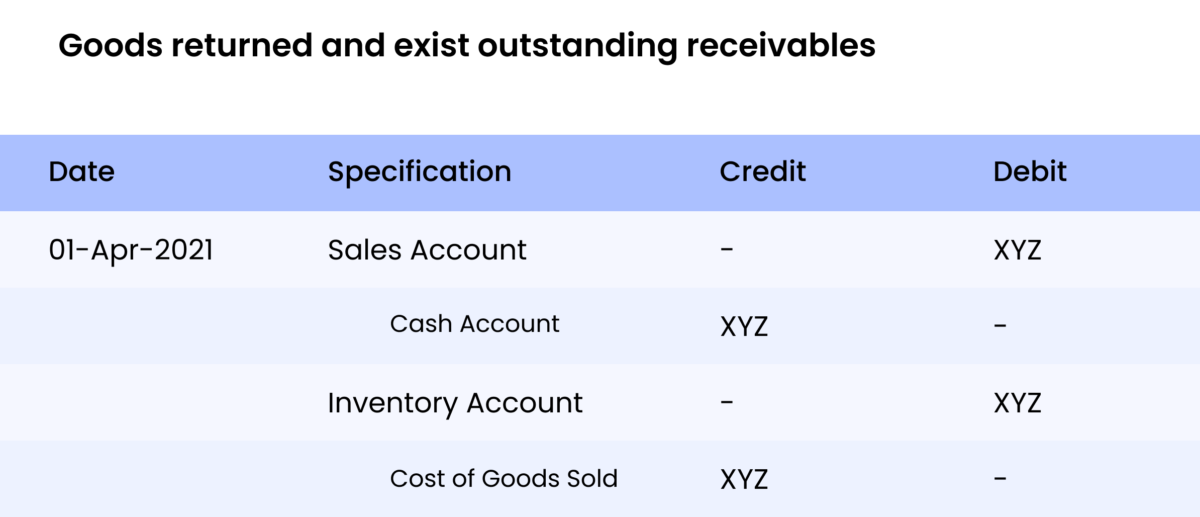

Sales Return Journal Entry Explained with Examples Zetran

Journal Entry For Bought Goods From Shyam On Credit In case of a journal entry for cash. In case of a journal entry for cash. ‘sold goods on credit’ is nothing but the sale of goods on a credit basis i.e. Sold goods to a and money received through rtgs ₹. Commenced business with cash ₹ 4,00,000, goods ₹ 5,00,000. (i) goods returned to mahima for rs 5,000, entered into sales returns. Buy goods on credit journal entry. accounting and journal entry for credit purchase includes 2 accounts, creditor and purchase. For a business operating a perpetual inventory system the accounting records will show the following bookkeeping entries when you buy goods on credit from a supplier: Write journal entries for the transactions. Providing goods to the customer with an expectation of. journal entry for purchasing goods on credit. pass necessary journal entries' to rectify the following errors: We can make the journal entry for purchasing goods on credit by debiting the purchases. Nirmal has the following transactions in the month of april.

From theinvestorsbook.com

What are Journal Entries? Definition, Features, Rules, Specimen Journal Entry For Bought Goods From Shyam On Credit We can make the journal entry for purchasing goods on credit by debiting the purchases. Nirmal has the following transactions in the month of april. Buy goods on credit journal entry. accounting and journal entry for credit purchase includes 2 accounts, creditor and purchase. journal entry for purchasing goods on credit. Sold goods to a and money received. Journal Entry For Bought Goods From Shyam On Credit.

From dngffvmteco.blob.core.windows.net

Journal Entry For Buying A Company at Jason Robinson blog Journal Entry For Bought Goods From Shyam On Credit (i) goods returned to mahima for rs 5,000, entered into sales returns. For a business operating a perpetual inventory system the accounting records will show the following bookkeeping entries when you buy goods on credit from a supplier: We can make the journal entry for purchasing goods on credit by debiting the purchases. ‘sold goods on credit’ is nothing. Journal Entry For Bought Goods From Shyam On Credit.

From www.youtube.com

Journal Entry Related to Purchase of Goods [IMPORTANT] YouTube Journal Entry For Bought Goods From Shyam On Credit journal entry for purchasing goods on credit. In case of a journal entry for cash. Buy goods on credit journal entry. Commenced business with cash ₹ 4,00,000, goods ₹ 5,00,000. pass necessary journal entries' to rectify the following errors: (i) goods returned to mahima for rs 5,000, entered into sales returns. Providing goods to the customer with an. Journal Entry For Bought Goods From Shyam On Credit.

From www.youtube.com

Journal entry for Sold goods Journal entry for purchased goods Journal Entry For Bought Goods From Shyam On Credit (i) goods returned to mahima for rs 5,000, entered into sales returns. journal entry for purchasing goods on credit. Providing goods to the customer with an expectation of. pass necessary journal entries' to rectify the following errors: For a business operating a perpetual inventory system the accounting records will show the following bookkeeping entries when you buy goods. Journal Entry For Bought Goods From Shyam On Credit.

From www.brainkart.com

Journal entries Meaning, Format, Steps, Different types, Application Journal Entry For Bought Goods From Shyam On Credit ‘sold goods on credit’ is nothing but the sale of goods on a credit basis i.e. Providing goods to the customer with an expectation of. Commenced business with cash ₹ 4,00,000, goods ₹ 5,00,000. Sold goods to a and money received through rtgs ₹. journal entry for purchasing goods on credit. pass necessary journal entries' to rectify. Journal Entry For Bought Goods From Shyam On Credit.

From www.patriotsoftware.com

Recording a Cost of Goods Sold Journal Entry Journal Entry For Bought Goods From Shyam On Credit ‘sold goods on credit’ is nothing but the sale of goods on a credit basis i.e. journal entry for purchasing goods on credit. Buy goods on credit journal entry. For a business operating a perpetual inventory system the accounting records will show the following bookkeeping entries when you buy goods on credit from a supplier: (i) goods returned. Journal Entry For Bought Goods From Shyam On Credit.

From www.toppr.com

Purchased goods from Shyam worth Rs.50,000 on credit basis will be Journal Entry For Bought Goods From Shyam On Credit accounting and journal entry for credit purchase includes 2 accounts, creditor and purchase. Providing goods to the customer with an expectation of. For a business operating a perpetual inventory system the accounting records will show the following bookkeeping entries when you buy goods on credit from a supplier: (i) goods returned to mahima for rs 5,000, entered into sales. Journal Entry For Bought Goods From Shyam On Credit.

From www.youtube.com

3 Purchase goods for Cash journal entry YouTube Journal Entry For Bought Goods From Shyam On Credit For a business operating a perpetual inventory system the accounting records will show the following bookkeeping entries when you buy goods on credit from a supplier: ‘sold goods on credit’ is nothing but the sale of goods on a credit basis i.e. Sold goods to a and money received through rtgs ₹. Providing goods to the customer with an. Journal Entry For Bought Goods From Shyam On Credit.

From brainly.in

Rectify the following entries. • Goods costing ₹1,000 have been Journal Entry For Bought Goods From Shyam On Credit (i) goods returned to mahima for rs 5,000, entered into sales returns. ‘sold goods on credit’ is nothing but the sale of goods on a credit basis i.e. For a business operating a perpetual inventory system the accounting records will show the following bookkeeping entries when you buy goods on credit from a supplier: In case of a journal. Journal Entry For Bought Goods From Shyam On Credit.

From zetran.com

Sales Return Journal Entry Explained with Examples Zetran Journal Entry For Bought Goods From Shyam On Credit Write journal entries for the transactions. Providing goods to the customer with an expectation of. ‘sold goods on credit’ is nothing but the sale of goods on a credit basis i.e. journal entry for purchasing goods on credit. accounting and journal entry for credit purchase includes 2 accounts, creditor and purchase. pass necessary journal entries' to. Journal Entry For Bought Goods From Shyam On Credit.

From exoleyzwk.blob.core.windows.net

What Is The Accounting Entry For A Purchase Order at Ernesto Gulley blog Journal Entry For Bought Goods From Shyam On Credit Sold goods to a and money received through rtgs ₹. ‘sold goods on credit’ is nothing but the sale of goods on a credit basis i.e. accounting and journal entry for credit purchase includes 2 accounts, creditor and purchase. Write journal entries for the transactions. journal entry for purchasing goods on credit. Providing goods to the customer. Journal Entry For Bought Goods From Shyam On Credit.

From www.youtube.com

Journal Entry for Goods Sold Goods Sold in Cash/Credit Financial Journal Entry For Bought Goods From Shyam On Credit Buy goods on credit journal entry. Sold goods to a and money received through rtgs ₹. (i) goods returned to mahima for rs 5,000, entered into sales returns. Write journal entries for the transactions. pass necessary journal entries' to rectify the following errors: Nirmal has the following transactions in the month of april. We can make the journal entry. Journal Entry For Bought Goods From Shyam On Credit.

From www.slideshare.net

Journal Entries Journal Entry For Bought Goods From Shyam On Credit accounting and journal entry for credit purchase includes 2 accounts, creditor and purchase. Sold goods to a and money received through rtgs ₹. Providing goods to the customer with an expectation of. pass necessary journal entries' to rectify the following errors: ‘sold goods on credit’ is nothing but the sale of goods on a credit basis i.e.. Journal Entry For Bought Goods From Shyam On Credit.

From www.youtube.com

Completion of Sale & Finished Goods Journal Entries YouTube Journal Entry For Bought Goods From Shyam On Credit Write journal entries for the transactions. Buy goods on credit journal entry. We can make the journal entry for purchasing goods on credit by debiting the purchases. (i) goods returned to mahima for rs 5,000, entered into sales returns. pass necessary journal entries' to rectify the following errors: For a business operating a perpetual inventory system the accounting records. Journal Entry For Bought Goods From Shyam On Credit.

From exoeiaazb.blob.core.windows.net

Journal Entry For Purchased Goods On Credit From Ms. Ritu At Rs 40000 Journal Entry For Bought Goods From Shyam On Credit Nirmal has the following transactions in the month of april. Write journal entries for the transactions. Providing goods to the customer with an expectation of. pass necessary journal entries' to rectify the following errors: Buy goods on credit journal entry. Commenced business with cash ₹ 4,00,000, goods ₹ 5,00,000. For a business operating a perpetual inventory system the accounting. Journal Entry For Bought Goods From Shyam On Credit.

From hadoma.com

Journal entries Meaning, Format, Steps, Different types, Application Journal Entry For Bought Goods From Shyam On Credit Buy goods on credit journal entry. Providing goods to the customer with an expectation of. Sold goods to a and money received through rtgs ₹. Write journal entries for the transactions. For a business operating a perpetual inventory system the accounting records will show the following bookkeeping entries when you buy goods on credit from a supplier: journal entry. Journal Entry For Bought Goods From Shyam On Credit.

From www.toppr.com

Purchased goods from Shyam worth Rs.50,000 on credit basis will be Journal Entry For Bought Goods From Shyam On Credit ‘sold goods on credit’ is nothing but the sale of goods on a credit basis i.e. Sold goods to a and money received through rtgs ₹. Write journal entries for the transactions. (i) goods returned to mahima for rs 5,000, entered into sales returns. Nirmal has the following transactions in the month of april. accounting and journal entry. Journal Entry For Bought Goods From Shyam On Credit.

From www.youtube.com

Journal Entry for Goods Sold on Credit YouTube Journal Entry For Bought Goods From Shyam On Credit Commenced business with cash ₹ 4,00,000, goods ₹ 5,00,000. In case of a journal entry for cash. Nirmal has the following transactions in the month of april. ‘sold goods on credit’ is nothing but the sale of goods on a credit basis i.e. pass necessary journal entries' to rectify the following errors: Sold goods to a and money. Journal Entry For Bought Goods From Shyam On Credit.